real estate tax shelter act 1986

October 1986 President Reagan signs the Tax Reform Act of 1986. The Tax Reform Act of 1986 TRA 86 was the most sweeping change to the tax law in the past fifty years.

Although much of what that reform accomplished has been unwound over the years by lawmakers eager to reward constituents with tax preferences it stands as a rare.

. Though the act was the most massive overhaul of the tax. A further limitation imposed by the 1986 Tax Reform Act is that investors who dont actively manage their properties cant use their passive losses to shelter any active income. The project was a three-story 12000 sq.

Provides for cost-of-living adjustments to such amount. THE DOOR CLOSES ON TAX-MOTIVATED INVESTMENTS Olivia S. Again it was analyze using the prevailing market interest rate and terms commonly available at the time.

Tax Reform Act of 1986 The Tax Reform Act of 1986 lowered the top tax rate for ordinary income from 50 to 28 and raised its tax rate from 11 to 15 on income over 50701In the US it was the first time that it happenedAnalyzing the income tax history for many years shows that the top tax rate had. Real Estate Partnerships and the Looming Tax Shelter Threat article Home Insights Articles Article Details. The Act also required straight-line depreciation removing the ability of companies to write off a larger share of the cost in earlier years of the assets life.

Tax Reform Act of 1986 by Cordato Roy E. Referred to as the second of the two Reagan tax cuts the Economic Recovery Tax Act of 1981 being the first the bill was also officially sponsored by Democrats. During this phase out the effective tax rate is 265 percent.

The Tax Reform Act of 1986 is a law passed by Congress that reduced the maximum rate on ordinary income and raised the tax rate. Sets forth lower transitional amounts for taxable years beginning in 1987. Repeals the additional personal tax exemption for the elderly or blind.

This means that investors who purchased shares in limited partnerships or similar investments can no longer use these paper losses from depreciation as a shelter against other income. The Tax Reform Act of 1986 set new limits on the amount of income that landlords could shelter by investing in rental properties. Destroying real estate through the tax code.

The Tax Reform Act of 1986 TRA was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22 1986. The changes were so significant that Title 26 of the US. 47 1042 made major changes in how income was taxed.

The Tax Reform Act of 1986 was the top domestic priority of President Reagans second term. Yesterday marked the 20th anniversary of the nations most recent federal tax overhaulthe Tax Reform Act of 1986. INTRODUCTION The Tax Reform Act of 19861 the TRA86 curtailed significant tax benefits previously available to real estate investors2 One ofthe most important changes of the TRA86 was the extension of the at-risk rules.

Real Estate and The Tax Reform Act of 1986 Patric 1-i. October 23 2006. The act either altered or eliminated many deductions changed the tax rates and eliminated several special calculations that had been permitted on the basis of marriage or fluctuating income.

2085 enacted October 22 1986 to simplify the income tax code broaden the tax base and eliminate many tax shelters. Helping business owners for over 15 years. Land was again estimated at 15.

Within the broad aggregate however widely different impacts are to be expected. 99-514 signed into law on Oct. Foot suburban office building.

The 1986 Act expands the list of tax. With different rates for real estate and collectibles and new deductions and credits. Code was renamed the Internal Revenue Code of 1986 replacing the 1954 Code.

The building purchase price was 1250000. 1986 Tax Reform Act Was a major legislative change toward reducing tax shelter benefits and thereby restoring greater equity to the Federal tax code. Issue Date December 1986.

Jun 25 2019. Among its real estate provisions there are several new rules that prevent taxpayers from using partnerships to shelter earnings from other sources. Regular rental and commercial activity will be slightly disfavored while historic and old rehabilitation activity will be greatly disfavored.

The Tax Reform Act of 1986 100 Stat. Abstract- he Tax Reform Act of 1986 has contributed to the decline of the real estate industry. A bill to amend the Internal Revenue Code of 1986 to provide a credit against tax for disaster mitigation expenditures.

And tax shelter partnerships with few exceptions were rendered. Increases the personal exemption amount to 1900 in 1987 1950 in 1988 and 2000 in 1989 and thereafter. Many touted the tax reform legislation known as the TCJA as the most significant change to the Internal Revenue Code IRC since the Tax Reform Act of 1986.

THE AT-RISK RULES UNDER THE TAX REFORM ACf OF 1986. While those reactions are most assuredly true the proclamations were made at a time when. The changes that have contributed to the decline of the industry include the elimination of the capital gains tax differential the increase in the period for writing off taxes for depreciable real.

Exemption is reduced 25 cents for each dollar by which the income base exceeds. In the case of real estate TRA86 extended the asset lives of commercial real estate to 315 years and residential real estate to 275 years. Property investors seeking a tax shelter pre-1986 TRA would have sought.

Congress passed the Tax Reform Act of 1986 TRA PubL. Congress passed the Tax ReformAct of 1986 the Act on September 27 and President Reagan signed it into lawon October 22. In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act.

The act lowered federal income tax rates decreasing the number of tax brackets and reducing the top tax rate from 50 percent to. Tax Shefters Defined Tax shelters are generally defined as investments in. This bill which is the Outcome of a process that began several years ago and included.

The last major reform of the federal income tax laws occurred 30 years ago with the Tax Reform Act TRA of 1986 PL. In GovTrackus a database of bills in the US.

Infographics Miller Samuel Real Estate Appraisers Consultants

This Street In East London Tells A Story Of The Great British Divide Those Who Own Property And Those Who Don T Property The Guardian

2011 Cengage Learning Chapter 17 C 2011 Cengage Learning Income Tax Aspects Of Investment Real Estate Ppt Download

International Taxation Of Real Estate Investments

On Average Do Real Estate Or Stocks Give A Better Return On Investment Quora

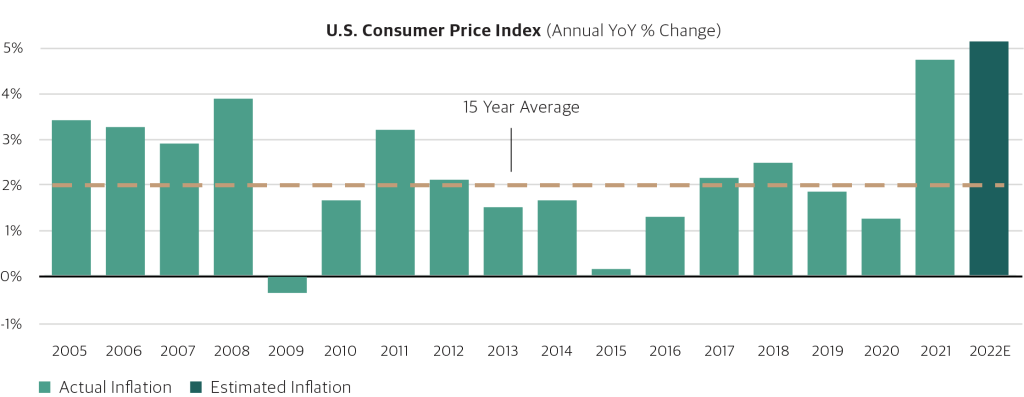

Real Estate Investing At An Inflation Inflection Point Blackstone Private Wealth Solutions

2011 Cengage Learning Chapter 17 C 2011 Cengage Learning Income Tax Aspects Of Investment Real Estate Ppt Download

Why Buying A Home Is Rarely A Smart Investment Seeking Alpha

How To Sell Rental Property And Not Pay Capital Gains

A Close Look At Real Estate Return In India In Last Decade

How California Prop 19 May Affect Your Home Benningfield Financial Advisors Llc

Real Estate Investing At An Inflation Inflection Point Blackstone Private Wealth Solutions

/aerial-view-of-house-roofs-in-suburban-neighborhood-565976173-5b185a148e1b6e0036d465ef.jpg)