north carolina real estate taxes

North Carolina does not collect an inheritance tax or an estate tax. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million.

The out-of-state tax credit is.

. In 2012 North Carolina had three tax brackets from 0 to 775 percent depending on taxable income while South Carolina had six brackets from 0 to 7 percent. Even if you are a resident of North Carolina if you inherit property from another state that state may have an estate tax that applies.

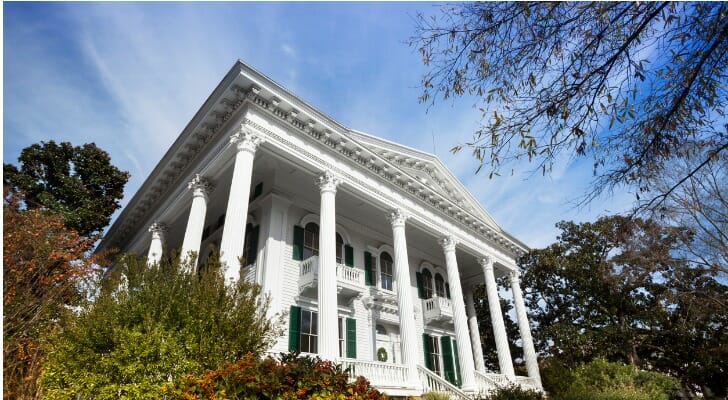

North Carolina Real Estate Transfer Taxes An In Depth Guide

Wake County Nc Property Tax Calculator Smartasset

The Ultimate Guide To South Carolina Real Estate Taxes

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

Pbmares Insights 2021 North Carolina Tax Reform

How To Calculate Closing Costs On A Home Real Estate

North Carolina Gift Tax All You Need To Know Smartasset